Six companies were unable to pay claims because they did not have adequate reinsurance — insurance coverage for insurance companies to cover massive property loss events — for Hurricane Ida. Also, the report said more property insurers have left the state because of potential losses due to the multiple hurricane landfalls in 2020 and 2021.

According to the report, the private nonprofit Louisiana Insurance Guaranty Association had the cost of claims and premium refunds increase from $4.8 million in calendar year 2020 to about $268.1 million in the first eight months of 2022. LIGA functions as the safety net in case an insurance carrier can’t pay claims because of insolvency.

LIGA is not funded by taxpayers but can under state law to levy a fee of 1% of total premiums written in the previous calendar year to meet its obligations. LIGA was forced to assess insurance companies operating in the state for the first time since 2004 and also borrowed $600 million to cover its expenses. That borrowing could be costly, as the principal and interest payments could range anywhere from $721.6 million to $884.6 million if the full $600 million is borrowed.

The nonprofit, quasi-public Louisiana Citizens Property Insurance Corp. — which is funded by premiums and assessments on private insurers that can be levied if required and is the insurer of last resort for coastal property owners — has seen the number of policies increased by 214.1%, going from 35,670 policies in January 2021 to 112,035 policies in August 2022. The amount of property insured by Citizens has increased from $6.7 billion to $33.3 billion, an increase of 397% in total insured value.

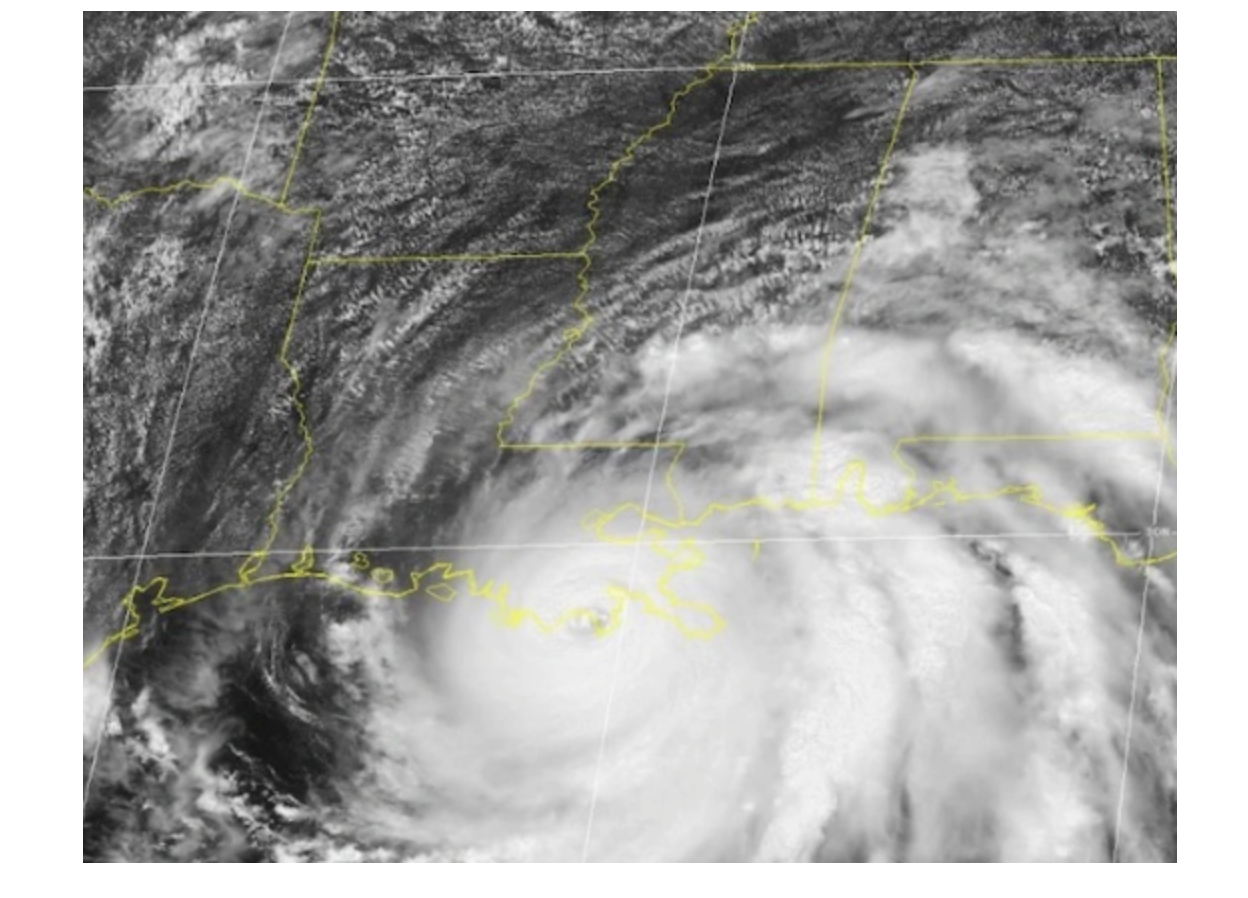

In the last two years, Louisiana has been hit by Hurricanes Laura, Delta and Ida. Laura made landfall in Cameron Parish on Aug. 27, 2020, while Delta hit near Creole, La. on Oct. 9. The next year, Ida made landfall near Port Fourchon on Aug. 29.