Capital Area United Way announces free tax preparation opportunities

Published 11:25 am Wednesday, January 19, 2022

|

Getting your Trinity Audio player ready...

|

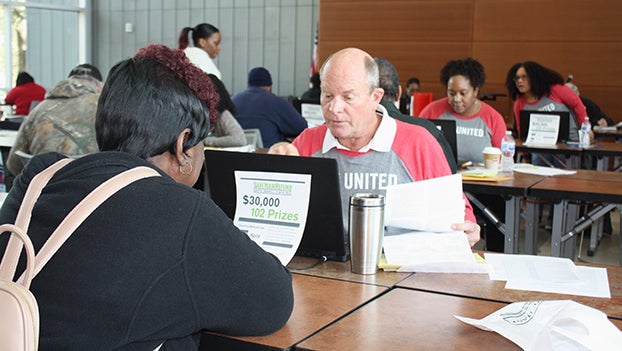

BATON ROUGE – Capital Area United Way’s Volunteer Income Tax Assistance (VITA) program is now open for the 2021 tax season, which officially begins on Monday, January 24. VITA will run through Tax Day, which is Friday, April 15. This year, CAUW has 22 permanent sites and seven mobile sites that will open for in-person appointments or for drop offs. United Way 211/CAUW is currently accepting appointments for VITA.

Capital Area United Way serves 10 Southeast Louisiana parishes, including St. James. To locate a VITA site, visit https://www.cauw.org/vita

“Following a tremendously successful year in the middle of the COVID-19 pandemic, we are thrilled to continue offering this service to our community,” said George Bell, President and CEO of Capital Area United Way. “Our volunteers are ready to serve those in need of assistance to ensure they do not fall behind their taxes.”

Volunteers will also begin preparing taxes virtually through www.getyourrefund.org/CAUWBR. The virtual tax prep service is set to launch February 7. The online service Myfreetaxes.com will open on January 24, and clients will be able to do their own taxes for free.

In addition to regular VITA sites, CAUW will bring back the annual Super Tax Day event, sponsored by Entergy Louisiana, on

Saturday, February 19 from 8 a.m. – 3 p.m. at the East Baton Rouge Parish Main Library, located at 7711 Goodwood Blvd. in Baton Rouge. Super Tax Day is walk-in only, and no advanced appointments will be accepted. No clients will be checked in after 3 p.m.

In order for certified tax prep volunteers to prepare your taxes, please provide the following documents:

- Photo ID (for you and your spouse, if filing jointly)

- Social Security Card or ITN for each family member of your household

- W-2 forms for all jobs, all 1099 or 1098 forms and information on other income received

- Child Care provider name, address and tax ID number

- Checking and savings account numbers

- Last year’s tax return

- 1095-A Health Insurance Marketplace Statement (if applicable)

- Stimulus Payments: IRS Letter 1444-C or bank verification of stimulus amount received (if applicable)

- Enhanced Child Tax Credit: IRS Letter 6419 (if applicable)

- Other relevant information about income and expenses

The VITA program provides free tax preparation throughout the year to individuals in the community, especially low-income workers, the elderly and individuals with disabilities. The program’s objective is to help eligible taxpayers receive the Earned Income Tax Credit (EITC) to improve their financial stability, one of the focus areas of Capital Area United Way.

For more information about VITA sites and services visit call 2-1-1, visit www.cauw.org/vita, or text “freetaxes” to 313131.

VITA is sponsored by Entergy; Capital One; Code for America; IRS; and Get Your Refund.