Gloor: Ask Rusty – No dumb questions about Social Security

Published 6:39 am Saturday, September 26, 2020

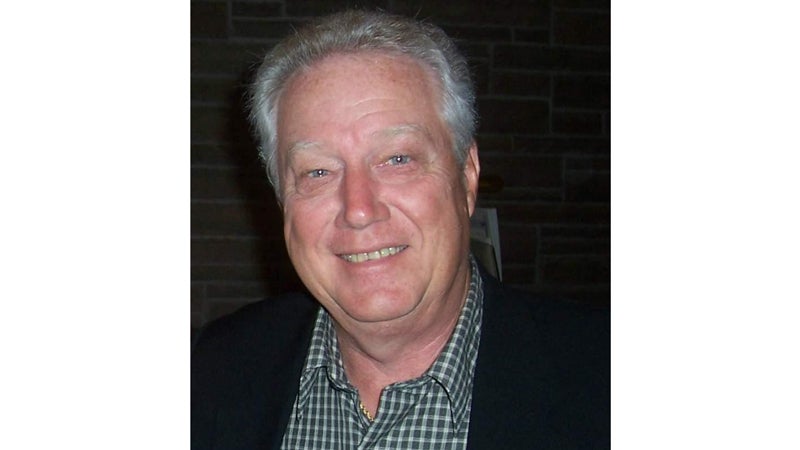

- Russell "Rusty" Gloor

|

Getting your Trinity Audio player ready...

|

Editor’s Note: This article is intended for information purposes only and does not represent legal or financial guidance. It presents the opinions and interpretations of the AMAC Foundation’s staff, trained and accredited by the National Social Security Association (NSSA). NSSA and the AMAC Foundation and its staff are not affiliated with or endorsed by the Social Security Administration or any other governmental entity. To submit a question, visit our website (amacfoundation.org/programs/social-security-advisory) or email us at ssadvisor@amacfoundation.org.

Dear Rusty: I have some questions about Social Security, but I’ve never been old before so these may be dumb questions.

- My 66th birthday is in October 2021; do I put in for Social Security in January 2022? Or when?

- I am a 30-year military retiree. Do I need to bring my DD-214 to the SSA Office when I apply?

- My wife has not held a job outside the home, but she has worked as hard if not harder than me, running and taking care of our home and affairs when I was away a lot of the time. She turns 66 in September 2022. Can she apply for Social Security, and if so, does she get a percentage of what I get?

Thank you for any help you can give me. Signed: Retired Military

Dear Retired Military: There are no dumb questions, especially when it comes to Social Security which has over 2,700 different rules sure to perplex even the most learned among us. I’ll answer your questions in the order you posed them:

- Your full retirement age (FRA) is 66 years and 2 months. Your FRA is when you get 100 percent of the benefit you’ve earned from a lifetime of working. Claiming earlier will mean a reduced benefit; waiting longer can mean a larger benefit. If you wish to claim benefits at your FRA in December 2021, you should apply for those benefits in September 2021 (SS suggests you apply three months before you wish benefits to begin). Just be sure to specify your benefit start month as December to get your full benefit.

- You do not need your DD-214 when you apply for Social Security. Your earnings during your military career are already known to Social Security and will, along with any non-military earnings, form the basis for your Social Security benefit. Your SS benefit will be based upon the highest-earning 35 years of your lifetime earnings career, adjusted for inflation. You do not need to go to the SS office to apply; you can apply over the phone (call to make an appointment first) or online at www.ssa.gov/retire. Applying online is by far the easiest way to claim your benefits.

- Even though your wife is not eligible for SS benefits on her own work record, she can still collect a spousal benefit from you. If she waits until she reaches her FRA before she claims, she’ll get 50 percent of the benefit you are entitled to at your full retirement age. Your wife’s FRA is 66 years and 4 months and, although she can claim the spouse benefit before that, if she does it will be actuarially reduced according to the number of months before her FRA that she claims. FYI, your wife cannot collect her spousal benefit until you have started to collect your benefits.

Finally, thank you for your many years of service to our country. Your pay while serving will be part of the 35 highest-earning years over your lifetime used to compute your Social Security benefit.

Russell Gloor is a certified Social Security advisor for the Association of Mature American Citizens (AMAC). AMAC is a non-profit, non-partisan senior advocacy organization that takes its marching orders from its members and is dedicated to supporting and educating America’s Seniors. They act and speak on the Association members’ behalf, protecting their interests and offering practical insights on how to best solve problems they face. They can be contacted at www.amac.us.